2025 U.S. Proxy Season Review: Navigating Complexity in a Changed World

Corporate Boards find themselves in a changed world this proxy season. The tide of shareholder and regulatory pressure on corporations to disclose and take action on environmental and social causes has subsided, while a wave of new risks ranging from new technology to geopolitical tension and potential trade wars disrupts the market. Every week seems to bring a new development, from changes in how investors view certain topics to SEC rules and guidance. Boards are being pulled in many, sometimes contradicting, directions, and must carefully navigate a myriad of legal, compliance, climate, social, political, and technological risks. As the 2025 Proxy Season approaches, ISS-Corporate examines key trends and themes that are likely to have significant impact.

KEY TAKEAWAYS

- The SEC’s updated its compliance and disclosure interpretations, prompting some investors to pause or change their engagement strategy. That means issuers may face difficulties engaging with investors ahead of their shareholder meetings.

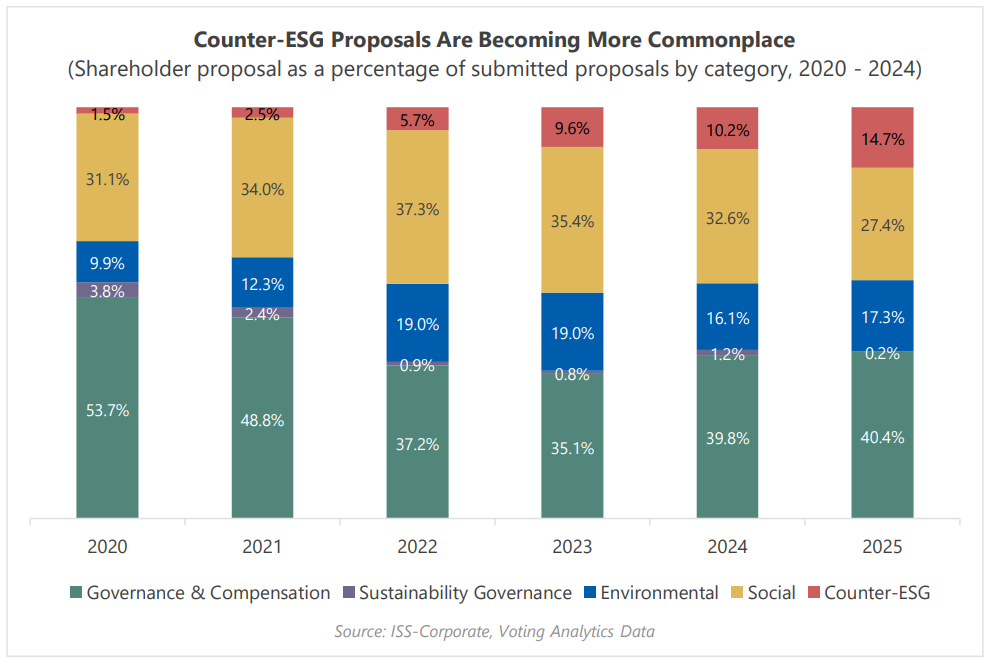

- Pushback against ESG and DEI initiatives is intensifying, and the surge of shareholder proposals criticizing certain environmental or social initiatives continues, representing 14.7% of all proposals submitted thus far for 2025.

- Though these counter-ESG proposals rarely receive broad shareholder support, some companies are likely to concede or make compromise to reach an agreement before the matter comes to a vote. Trend to watch: withdrawals.

- Disclosure of diversity information and use of diversity metrics in executive pay is expected to diminish, and board diversity considerations are likely to play a much smaller role this proxy season.

- Amid rising complexity and diversity of viewpoints the investor community, boards can look to the fundamental principles of corporate governance to help guide their decisions: economic relevance of extra-financial factors, competent and independent boards, and alignment between pay and performance.

Changing Rules of the Game

As market participants started to gear up for the 2025 Proxy Season, the rules of engagement were quite literally upended, prompting issuers and investors to change their approaches rapidly. The U.S. Securities and Exchange Commission (SEC) issued a new compliance and disclosure interpretation (C&DI) on Feb. 11, 2025, updating the interpretation of what triggers 13D filing as opposed to 13G filing, changing the dynamics of issuer-investor engagements. Under the new C&DI, large passive investors who engage with issuers and go beyond a general discussion of their policy and their perspectives risk triggering more burdensome reporting requirements under the 13D filing. If an investor were to recommend a company to take a specific action and condition their support on a ballot item (such as director election), explicitly or implicitly, on the management’s response, the investor could be deemed as “influencing control” over the company. This has led some investors to reconsider their approach to issuer engagements, with some temporarily halting engagements or seeking to readjust their stewardship strategy. Issuers who have become accustomed to holding routine engagement meetings ahead of their annual shareholder meeting (AGM) may find investors’ doors shut this proxy season.

The SEC also issued a new Staff Legal Bulletin No. 14M (CF) on Feb. 12, 2025, rescinding Staff Legal Bulletin No. 14L (CF) that was issued in November 2021. Previously, proposals that raise issues “with a broad societal impact” such as climate change or human rights were allowed to move forward even if the significance to the subject company was limited. This was said to have encouraged a surge of shareholder proposals and a decrease in omitted proposals starting in 2022 [1] . The SEC has reversed the guideline, making it easier to block proposals that fail to make a clear case that the issue at hand is significant and material to the subject company. Proposals that seek intricate details, specific timeframes or methods of implementation, or are highly prescriptive in nature, could be excluded as well on the basis of “micromanagement.” The new guidance also refocuses the SEC’s approach on the economic relevance of a shareholder proposal. The onus will be on proponents to demonstrate that the issue at hand is significant and economically relevant, potentially resulting in more proposals being omitted.

Pushback Against ESG Intensifies

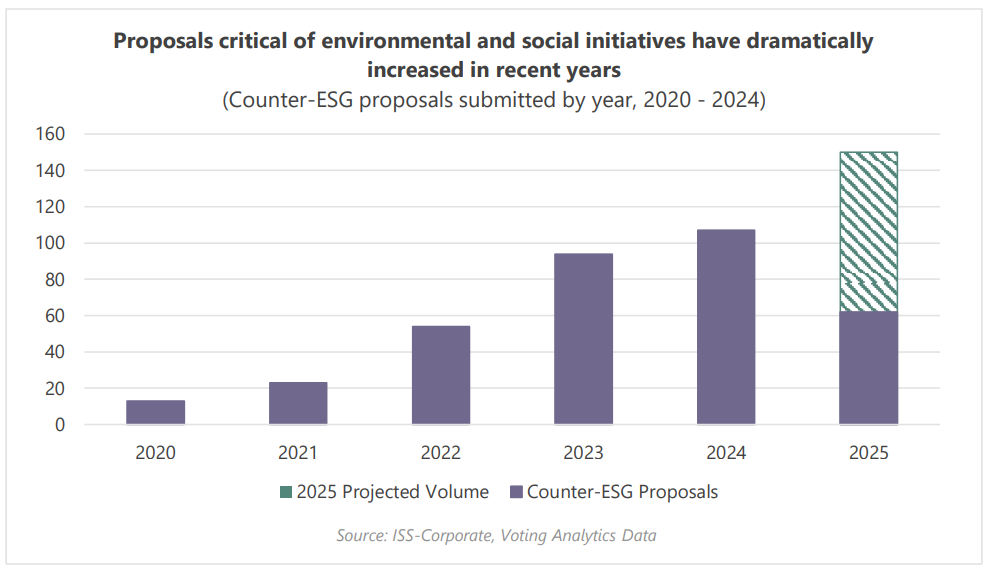

While fewer shareholder proposals may go to a final vote this proxy season, the volume may continue to increase, pushed by a surge in proposals critical of environmental or social initiatives. After peaking in volume in 2022, environmental and social shareholder proposals – such as those requesting companies to reduce GHG emissions or to report on gender and racial pay equity – have dropped, replaced by proposals that are skeptical of such initiatives. These socalled “counter-ESG” proposals have increased from 13 submitted in 2020 to more than 100 in 2024. As of February 2025, ISS-Corporate is tracking at least 62 counter-ESG proposals submitted for 2025 shareholder meetings. At the current pace, the total volume would exceed 150 for the year.

Counter-ESG proposals represent 14.7% of the 423 shareholder proposals submitted so far this year, up from 10.2% in 2024 and many boards will be forced to deliberate on these requests this year.

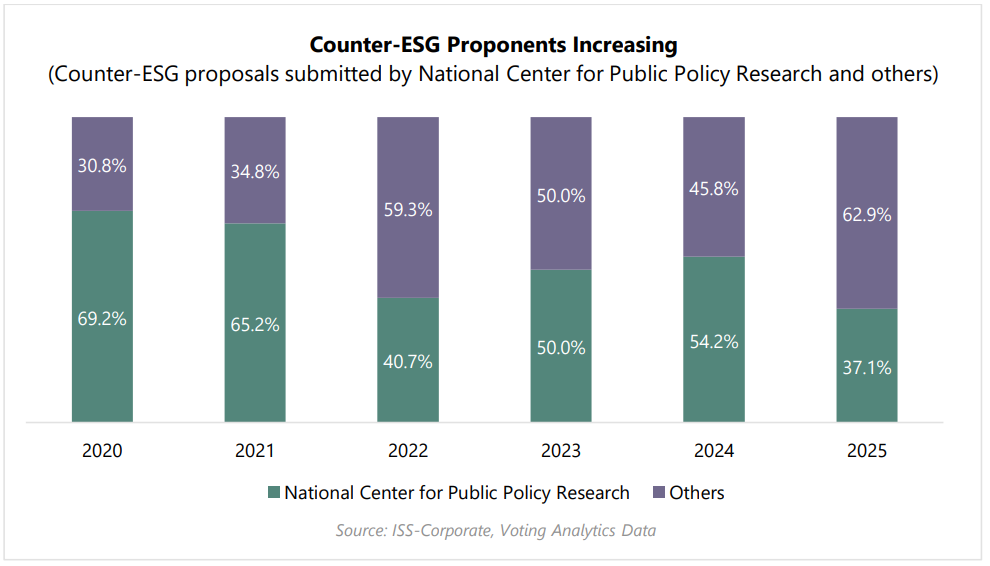

The number of investors who are exercising their rights to submit counter-ESG proposals is also rising. Just as “pro-ESG” proposals have prolific proponents, so do the counter-ESG proposals. The National Center for Public Policy Research has been the most active proponent, responsible for a majority of counter-ESG proposals. However, its share of the total has declined steadily from 69.2% in 202 to 37.1% YTD 2025. Investors joining the fray in recent years include state treasury funds, and more investors are expected to actively challenge environmental and social actions through shareholder proposals this proxy season.

Counter-ESG proposals have historically achieved limited success, with support levels averaging around 2% and only a handful of proposals withdrawn. Although the overall support levels may not drastically change this year, more boards may choose to settle with the proponent – making concessions or reaching an agreement to have the proposal dropped – than in the past. It is also possible that many of these proposals could be omitted under SLB 14M, and fewer may go to final vote.

Diversity, Equity, Inclusion in the Crosshairs

A vast majority of counter-ESG proposals are “social” proposals focused on diversity, equity, and inclusion (DEI), corporate political involvement, and charitable and political donation issues. More than 80% of counter-ESG proposals submitted between 2020 and 2024 dealt with social topics. Such proposals are set to increase dramatically in 2025 — as of this writing, we are tracking at least 50 such proposals.

DEI programs in particular have become a key target. Over 20 proposals submitted this year so far are critical of corporate DEI programs and initiatives, such as those calling companies to cease DEI efforts, abolish DEI program, report on risks of maintaining DEI efforts, or eliminate DEI goals from executive incentive programs. By contrast, only 14 proposals called for companies to improve DEI disclosure or practices.

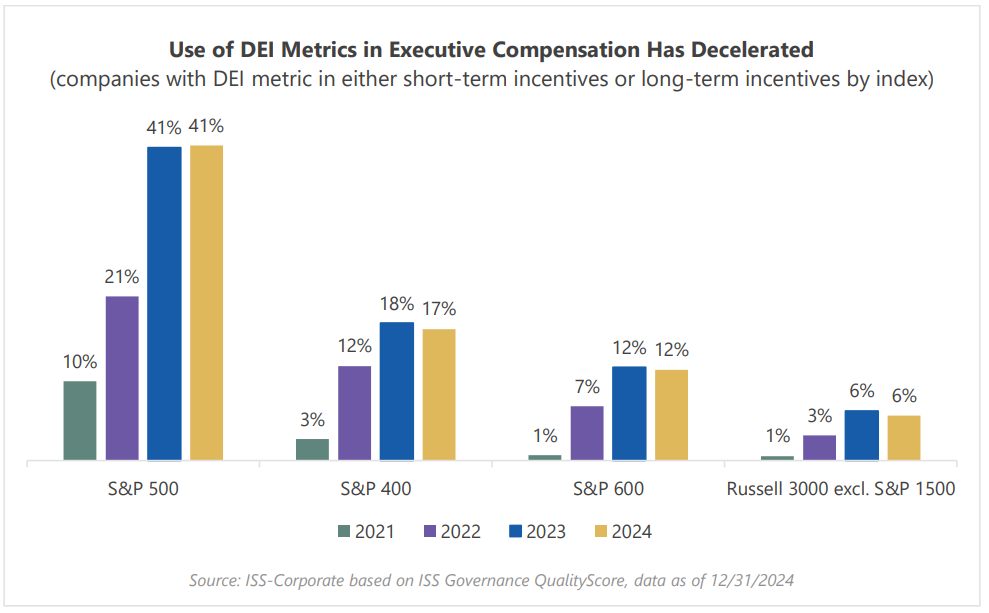

DEI in executive compensation has come under increased scrutiny from both sides. Some investors view DEI metrics in executive pay as discriminatory. Those more supportive of corporate DEI programs may be concerned about the rigor of DEI metrics in existing incentive plans, as diversity metrics are more likely to be achieved and yield a payout than financial metrics [2]. Use of DEI metrics in executive incentives rapidly expanded between 2021 and 2023, but lost momentum last year with the prevalence largely unchanged. The overall quality of disclosure on these metrics has increased over the years, but faced with increased shareholder scrutiny, companies may scale back on disclosure around DEI metrics in their 2025 proxy statement or start to modify or eliminate DEI metrics.

Overall disclosure of DEI-related information in proxy statements is expected to decrease this proxy season. The Nasdaq’s board diversity matrix disclosure requirement has been struck down in court, and fewer companies are expected to maintain it in their 2025 proxy statement. Responding to these developments, some investors have dropped or modified their policies related to board diversity, replacing numeric targets with a more nuanced approach.

Diversification of Investor Opinions and Voting Preferences

The dramatic rise of counter-ESG proposals underscores the diversity of viewpoints and perspectives the investor community has on any given topic. The investor community is not monolithic; investors hold different opinions about what matters to a company, and what responsibilities corporations should have toward their shareholders and society at large. Sometimes they find common ground: Some proposals submitted by prominent counter-ESG filers have in fact won broad investor support, such as those requiring an independent board chair and to report on AI data privacy.

Recognizing these diverse points of view, service providers and large asset managers have expanded their offerings to allow for greater flexibility in how votes are cast at shareholder meetings [3]. Boards that have traditionally relied on proxy advisors’ benchmark policies and top institutional investors’ guidelines as a barometer may struggle to understand why some proposals are receiving greater opposition at their 2025 AGM than they had before, particularly when investors are unwilling to engage with issuers.

Core Principles that Remain Constant

Although investor opinion is not uniform, there are many shared core principles that can help guide boards through the upcoming season.

Economic Relevance of Extra-Financial Factors – Despite the increasingly heated debate over whether corporate DEI programs or decarbonization efforts help build or erode shareholder value, the notion that shareholders need access to information that can have material impact on a company’s business to assess a firm’s risks and opportunities is unlikely to change. What is deemed relevant or material, however, will differ depending on the investor, and boards will need to carefully evaluate their shareholder base, risk exposures, and their materiality. These can include information security risks as well as compliance, reputational, and political risks. Proposals calling for transparency in lobbying activities and political spending are some of the most common shareholder proposals this proxy season.

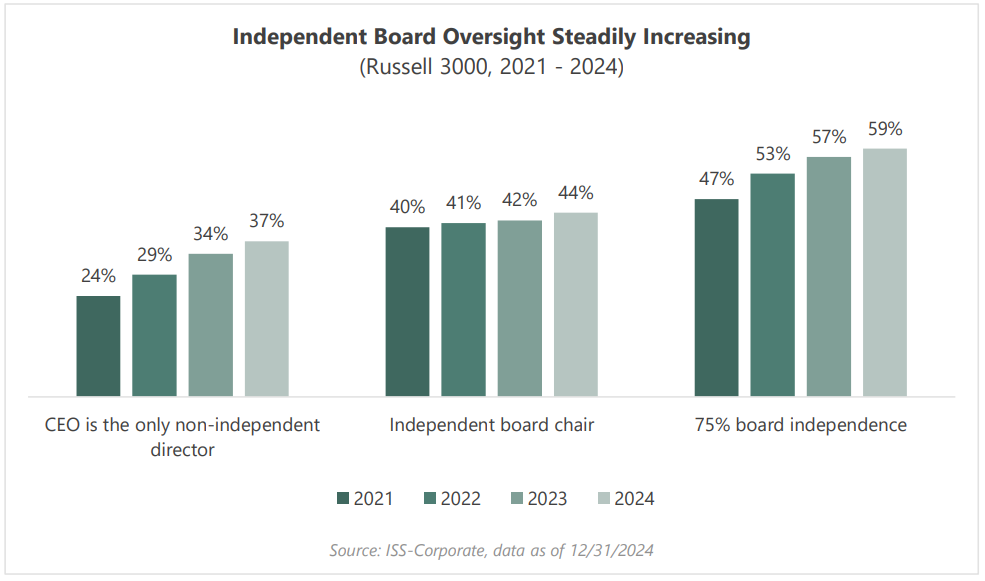

Independent and Competent Board – Regardless of political or ideological viewpoint, there is a broad recognition that robust oversight by an independent and competent board is vital to a company and its investors. Boards are expected to continue to evolve and enhance their oversight capabilities. Board independence among U.S. firms has gradually increased over the years, and a growing number of U.S. boards are chaired by an independent director. Both “progressive” and “conservative” investors have in recent years submitted proposals seeking to require an independent board chair, and those proposals often receive strong shareholder support.

Board gender or ethnic/racial diversity may not be a focal point come 2025 proxy season, but board competency is expected to receive continued scrutiny. Investors are likely to take a keen interest in the board’s preparedness to emerging areas of risks, particularly those related to technological issues such as cyber and AI. Boards are responding by expanding their oversight responsibilities to include cyber and AI, and actively recruiting directors with technology expertise.

Alignment between Pay and Performance – The fundamental belief that pay should reflect performance and that management’s interests should be aligned with shareholders remains unchanged. CEO compensation increased to an all-time high during the last proxy season, but say-on-pay support rebounded, resulting in record-low failures. While some may conclude that investor scrutiny over executive pay is easing, we argue that last year’s outcome indicates continued investor emphasis in pay and performance alignment. High CEO pay at many companies was in line with strong performance, and 2023 saw significantly fewer one-time special grants and discretionary pay adjustments as many companies returned to pre-pandemic norms. Pay that reflected performance, as well as limited and judicious use of discretionary payouts, contributed to broad investor support on say-on-pay last year. As the market dynamic shifts, some boards may consider making one-time grants or discretionary adjustments to executive incentives, which could result in pay and performance disconnect and potentially lead to high say-on-pay failures.

Navigating Complexity and Uncertainty

Boards will face increased complexity this proxy season, with conflicting stakeholder demands and an ever-expanding list of oversight responsibilities. What was the norm last year may no longer be the accepted best practice. As companies carefully navigate through a potentially treacherous proxy season – where they may need to reevaluate what to disclose, how to engage with stakeholders, and what changes are needed – it helps to get back to the very basics of corporate governance and ask the fundamental questions: What are the issues that matter the most to the company and its shareholders, does the board have the skills and independence needed to be effective, and is pay aligned with performance? Issuers that may no longer be able to rely on direct shareholder engagements for insights may need to seek alternative sources of inputs or glean insights into investor preferences through careful evaluation of extra-financial data and its usage.

1 For more information on shareholder proposal trends over the past decade, read “US Shareholder Proposals: A Decade in Motion.” (go back)

2 For a study of DEI metrics in executive compensation, see “The Momentum of DEI Metrics in Incentive Programs.” (go back)

3 Insert link/explain voting choices and specialty policies. (go back)

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release