Insights from earnings calls – what can we learn from corporate risk perceptions and sentiment?

Prepared by Malin Andersson, Juliette Guillotin and Pedro Neves

Published as part of the ECB Economic Bulletin, Issue 4/2024.

This box evaluates perceived risks and sentiment using evidence from corporate earnings calls.[1] Using textual analysis of earnings calls conducted by large euro area firms, this box derives timely measures of corporate perceptions of specific risks, as well as indices of demand and supply sentiment. Such analysis is particularly informative when assessing how firms perceive the repercussions of severe global shocks.

In the textual searches, words from a cluster of synonyms are matched to the transcripts of earnings calls, enabling the construction of risk and sentiment indices at a quarterly frequency.[2] More specifically, the selected risks relate to the COVID-19 pandemic, geopolitics, inflation, monetary policy, financial conditions and supply constraints. The resulting aggregate euro area risk index correlates well with the European Commission’s Economic Uncertainty Indicator (in its monthly business and consumer surveys), while the demand and supply sentiment indices co-move, respectively, with demand and equipment as factors limiting production (in its quarterly business and consumer surveys).[3]

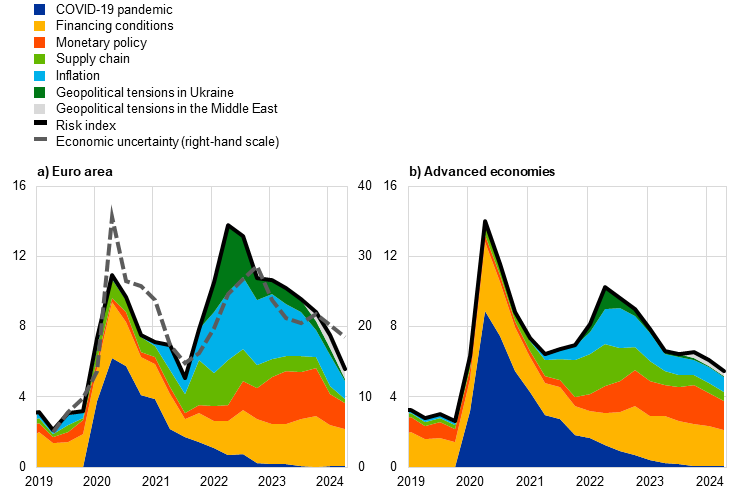

According to the earnings calls, risk perceptions of firms remain more elevated in the euro area than in other countries. The euro area has been particularly exposed to the large shocks that have hit the global economy in recent years and has felt the associated strong economic repercussions. Aggregate risk perceptions among larger firms – captured in risk indices derived from earnings calls – spiked simultaneously in the euro area and in other advanced economies at the time of both the first wave of the pandemic and Russia’s unjustified invasion of Ukraine. However, except at the height of the pandemic, risks were perceived to be more prominent in the euro area than elsewhere (Chart A). For instance, the pandemic led to unprecedented supply bottlenecks in the euro area manufacturing industry, and Russia’s invasion of Ukraine fuelled commodity price inflation and headline inflation. The risks associated with the monetary policy tightening in the course of 2022 were also perceived to be greater in the euro area. In the first half of 2024 the risk index was well above its level in 2019, albeit still lower than previous peak levels (Chart A). Euro area firms currently see the risks associated with inflation and monetary policy as elevated but decreasing. Risk perceptions related to the supply side and to Russia’s war against Ukraine have abated but are still present. The perceived risks from the tensions in the Middle East are so far marginal. Financing conditions (different from monetary policy) seem to be an ever-present risk for firms, which was thus also evident prior to the pandemic, although it is currently somewhat greater.

Chart A

Risk indices – firms’ perceptions of some major macroeconomic risks

(percentage of all risk sentences; net percentage balances)

Sources: NL Analytics, European Commission (DG ECFIN) and ECB staff calculations.

Notes: Risk reflects the frequency of the occurrence in firms’ earnings calls of words such as “risk” or similar, together with synonyms for COVID-19 pandemic (coronavirus, COVID-19, COVID-19 risk, COVID crisis); financing conditions (financial AND (crisis OR instability OR volatility), default, bankrupt*, sovereign, debt, liquidity, loan, lend*, funding cost*, financing cost*, credit capacity, credit availability, financing conditions, borrowing*); monetary policy (interest rate*, monetary, Federal Reserve, Fed, European Central Bank, ECB, FOMC, Bank of China, central bank, monetary authority); supply chain (supply chain, supply chain bottleneck, bottleneck, supply disruption, supply shortage, supply bottleneck, supply shock, supply constraint, supply tightness, supply chain risk); inflation (inflation); geopolitical tensions in Ukraine ((Ukrain* OR Russia*) AND (war OR invasion OR conflict OR geopoliti* OR violence OR crisis OR military OR tension*), Russia* AND gas); geopolitical tensions in the Middle East (Gaza, Israel, Hamas, Palestine, Palestinians, Israeli, Leban*, Houthi*, Iran, Yemen, Middle East AND (conflict OR war OR violence OR tension* OR crisis OR invasion OR military OR geopoliti*), Red Sea, Suez Canal). Euro area firms constitute around 8% of the entire sample. Among other advanced economies, US firms constitute 61% of the sample, UK firms 3% and firms from other advanced economies 15% (including Canada, Australia, New Zealand, Japan, South Korea, Norway, Switzerland and non-euro area EU Member States). The latest observations are for the second quarter of 2024 for earnings calls (conducted up to 31 May) and May for the uncertainty index.

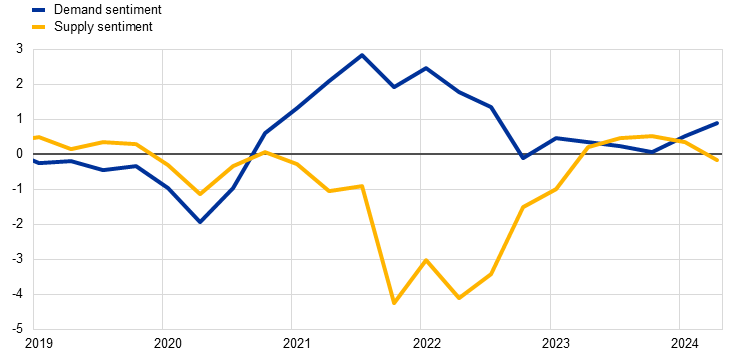

Transcripts from earnings calls can also be used to derive indices of sentiment among firms. Such indices give a combined nowcast and near-term view of the euro area business cycle, as executives often convey not only their views on the company’s prospects, but also their assessment of the business cycle and its outlook at both the sector and the macro level. The sentiment indices for demand and supply therefore help to detect shifts in the euro area business cycle in a timely manner. The method provides a complementary approach – as well as a consistent message – to other ways of identifying supply and demand shocks driving GDP, such as those based on structural vector autoregression models.[4]

Demand sentiment and supply sentiment have broadly normalised (Chart B). Demand conditions in the euro area – as illustrated by a demand sentiment index based on earnings calls – returned to their historical average in 2023. Demand sentiment was particularly high in 2021 and 2022 as the economy reopened after the pandemic. In the second half of 2022 it started to decline and deteriorated somewhat further in the course of 2023, in line with real GDP growth being close to zero. Thus far, the first half of 2024 has seen demand sentiment improve again, which is consistent with the pick-up in activity in the first quarter of 2024. As for supply, the sentiment index declined significantly in 2021 and 2022, owing to the emergence of severe supply bottlenecks and supply chain disruptions in the context of greater demand linked to the reopening of the economy. In early 2023 it rose significantly, exceeding its historical average at the end of the year, in line with the resolution of the supply bottlenecks. In the first half of 2024 it has declined slightly, but remained close to its historical average, which suggests that the tensions in the Middle East have not weighed significantly on firms’ perceived supply conditions. This picture tallies with the results of the European Commission’s business and consumer survey for the second quarter of 2024, which show that the perception of equipment as a factor limiting production has increased slightly and that demand is perceived as generally supporting production.

Chart B

Euro area demand and supply sentiment indices

(Z-scores)

Sources: NL Analytics and ECB staff calculations.

Notes: Net sentiment reflects the frequency of the occurrence of words for demand (demand) and supply (supply chain, supply chain bottleneck, bottleneck, supply disruption, supply shortage, supply bottleneck, supply shock, supply constraint, supply tightness, supply chain risk) in firms’ earnings calls. The Z-score is computed by subtracting the historical average from each data point and dividing this demeaned series by the standard deviation. The latest observations are for the second quarter of 2024 (for calls conducted up to 31 May).

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.