Resources Top 5: Cavalier hits record as it basks in warmth of robust PFS

A number of gold juniors are basking in the warmth of positive news and strong gold prices. Pic: Getty Images

- After delivering a robust revised PFS for the Crawford gold project, Cavalier Resources has set a new record

- Brightstar Resources has been one of the most active players on the ASX this week

- Antimony prices have hit a new record with Krakatoa Resources and Resolution Minerals among the beneficiaries

Your standout small cap resources stocks for Friday, April 4, 2025.

Cavalier Resources (ASX:CVR)

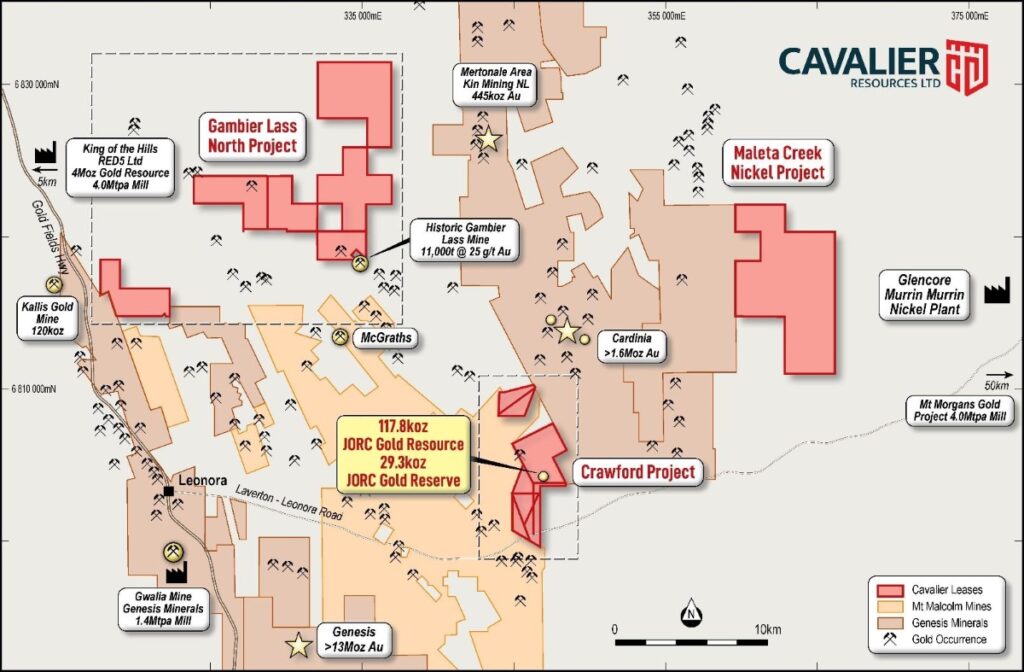

Cavalier Resources continues to bask in the warmth of Tuesday’s robust revised pre-feasibility study for the Crawford Gold Project near Leonora in WA, hitting a record 24c.

Release of the updated PFS saw shares up to 27.27% higher to 21c and three days later there has been a 37.14% to the new record, also supported by gold’s safe-haven strength in the face of economic headwinds.

The new PFS improved the financial outlook for the first stage of the Crawford project with an NPV of $51.7m and with pre-capex undiscounted cash flow of $66.7.

The internal rate of return is 580% from 23,467 recovered ounces with lowest quartile C1 AISC of $1574/oz and C3 AISC of $1793/oz. A gold price of $4600/oz was applied to the financials.

There is also considerable upside due to the first stage being constrained to the central oxide portion of the resource, which remains open along strike and at depth.

“This revised PFS update reflects a significantly improved financial outlook for Stage 1 and further underscores the outstanding overall potential of the greater Crawford Gold Project,” executive technical director & CEO Daniel Tuffin said.

“The combination of robust project economics, a record gold price and continued project advancement, positions Stage 1 at the Crawford Gold Project for even greater returns and increased development potential to build on for extension of further mining operations onsite.”

All compliance reports, works approvals and applications required for the start of mining the first stage have been submitted, including Project Management Plan, Native Vegetation Clearing Permit and Groundwater Extraction Licences. Native Title consultation with the traditional owners is ongoing.

Cavalier aims to establish the Crawford project as a new gold mining hub, aiming to become a self-funded near-mine explorer to further develop its gold assets in the Leonora region.

Having reached US$3116.70 on Friday morning, the gold price has slipped to around $3100 (~A$4968).

Brightstar Resources (ASX:BTR)

Another gold junior attracting interest is Brightstar Resources with around 280 million shares changing hands this week, including more than 109 million on Friday. The share price has ranged from 1.8 to 2.1c.

Earlier this week, the company exceeded expectations with its first pour from the Laverton Mill of Genesis Minerals resulting in 4297oz from 54,449 dry metric tonnes.

The reconciled head grade of 2.51g/t gold and the recovery rate of 94.25% exceeded estimates and reinforced BTR’s production profile ramp-up strategy for 2025 and 2026.

Last month the company welcomed the first gold pour as part of an ore purchase agreement with Genesis and metallurgical reconciliation from the first parcel has provided further encouragement.

“With haulage ongoing for our next processing parcel in May and development of the Fish Underground Mine on budget and schedule for delivering first ore in June, we’re building momentum towards sustained production growth and increased cash flows to fund the broader growth objectives across the company’s portfolio,” managing director Alex Rovira said.

These results positioned Brightstar to capitalise on record AUD gold prices, he said, as the company scaled-up operations.

Like other gold players, Brightstar hopes the Trump administration’s ‘reciprocal’ tariffs will continue to boost gold demand as they stoke inflation and harm risk assets.

Analysts at TD Securities say the tariffs will likely last at least until the 2026 midterms and that the secondary and tertiary effects will wreak havoc on silver and other industrial commodities.

“US details on tariffs were more aggressive, more immediate, more broad and seemingly more permanent than markets were expecting,” they wrote in a note on Thursday.

“President Trump announced a new baseline tariff of 10% on all imports into the US, with 40 countries plus the EU being charged a further increase over and above that as a reciprocal tariff. Further sectoral tariffs will be forthcoming, in addition to the 25% tariffs on autos taking effect on April 3.

“Our initial calculations suggest this is an average tariff rate of 30% on the 13 countries plus the EU, which account for almost all of the US trade deficit and $2.8tr in imports, and average 20% tariff rate on the remaining trading partners who account for a further $460bn of imports,” the analysts said.

“Maximal revenue estimates from that would be $600bn, in addition to the maximal $200bn from the existing IEEPA tariffs on Canada, Mexico and China, and potential revenues from sectoral tariffs of a further $200bn.”

The analysts expect that if the tariffs remain in place, they will keep inflation high over at least the next two months.

Infinity Lithium (ASX:INF)

Owing to ongoing permitting delays at its San Jose lithium project in Spain along with the continued downturn in the lithium market, Infinity Lithium has diversified by acquiring four granted, advanced high-grade gold and silver exploration assets in eastern Victoria.

This comes as the company acquires Highland resources, a subsidiary of unlisted Jubilee Metals, which is focused on the financing and proposed development of the Croydon gold project in Queensland.

The Victorian tenure at the southern end of the Lachlan Fold Belt covers historical gold fields and drill-ready high-grade targets with plenty of untested upside potential.

It includes the Comstock and Forsyth prospects within the Cobungra project along with the Mitta, Bindi and Good Hope-Union projects.

Comstock is undrilled but has walk-up drill targets defined by coincident IP geophysics and rock chip sampling of up to 4.4g/t gold and 303g/t silver.

Drilling permits have been approved, environmental bonding is in place and landholder access agreements have been secured.

Five holes at Forsyth have returned results up to 5.35m at 4.7g/t gold and 334g/t silver from 143m. Mineralisation is open and landholder agreements are in place to facilitate further drilling.

“Following a due diligence period we are very pleased to have acquired these enticing exploration assets, which have been underexplored over the past several years,” said Infinity executive chairman Adrian Byass.

“Set against a backdrop of strengthening gold prices and increased activity in eastern Australia, the company intends to rapidly and cost-effectively test these exploration assets whilst it maintains progress in Spain with its Direct Exploitation Concession Application (Mining Licence Application) for San Jose.

“To that end the company is mindful of the continued downturn in the broader lithium market and delays experienced with administrative bodies managing the permitting of San Jose.”

Immediate exploration is proposed in Victoria while the San Jose project licence application is being processed.

Shares have been up 31.6% from the previous close to a daily high of 2.5c after spiking at 2.8c on Tuesday.

Krakatoa Resources (ASX:KTA)

Antimony is another of the elements on critical minerals lists due to its industrial and military applications, including solar panel production, lead alloying for car batteries, bearings, cable sheathing and tin alloys for solder used in electronics and plumbing.

Antimony is used in semiconductors, electronics, glass, ceramics, pigments, plastic production, rubber vulcanisation, pharmaceuticals, brake pads, clutches, coatings, paints and universal flame retardants.

The antimony price hit a new all time high overnight of US$59,800/t.

An ASX junior following the antimony story closely is Krakatoa Resources (ASX:KTA) with the Zopkhito project in Georgia, in which it has an opportunity to acquire an 80% interest in the granted mining iicence.

Zopkhito hosts a foreign resource estimate of 225,000t at 11.6% Sb for 26,000t of antimony and 7.1Mt at 3.7g/t for 815,119oz of gold.

The modelling of IP results with topography data has resulted in a potential extension of the antimony-gold resource at depth and along strike.

KTA is compiling historical data and reviewing previous results with the aim of establishing priority target areas for drilling.

It then intends to complete a JORC standard mineral resource estimate and undertake a preliminary economic assessment.

“The company is focused on consolidating the extensive historical data and expanding the known footprint of the project and plans to initiate our first drill testing once permitting and access is available,” Krakatoa’s CEO Mark Major said.

Shares have been 25% higher to 1c.

Another company leveraged to the record antimony price is Resolution Minerals (ASX:RML) which this week found a multitude of targets at its Drake East project in NSW and shares have edged higher to 0.8c.

Alice Queen (ASX:AQX)

Looking to continue and enhance Fiji’s golden heritage is junior explorer Alice Queen with the Viani project on the nation’s second largest island Vanua Levu.

In late March the company confirmed the continuity of high-grade epithermal gold at Dakuniba prospect from surface to a depth of 175m.

The zone was initially intersected by the company’s first diamond hole at the prospect, which was drilled to test high-grade, low-sulphidation epithermal gold mineralisation previously mapped over a 3km area.

Hole 24VDD001 intersected several zones from 103.5 to 166.88m including 1.25m grading 2.24g/t gold and 12.48g/t silver from 107.9m and 1.9m at 8.52g/t gold and 13.1g/t silver from 144.2m.

This intersected high-grade mineralisation ~40m below the previous hole MJVFV-5 that struck 2.2m at 11.3g/t gold.

A second diamond hole, 25VDD002, has proved the depth continuity of this zone after returning a top assay of 4.14m at 6.13g/t gold and 9.42g/t silver from 195.76m, including 0.58m at 26.4g/t gold and 39.7g/t silver and 0.80m at 11.4g/t gold and 6.52g/t silver.

This was 80m below the mineralisation in 24VDD001 with both intersections occurring within a broader zone of anomalous gold from a down-hole depth of 44m that is hosted in intense sericite silica alteration.

Mineralisation remains open at depth and a third hole is being drilled to test 100m below 25VDD002.

Looking ahead, the company says the next phase of drilling will test for strike extensions to the mineralisation along the west-northwest, east-southeast zone of veining and gold anomalism.

This article does not constitute financial product advice. You should consider obtaining independent financial advice before making any financial decisions. While Brightstar Resources and Resolution Minerals are Stockhead advertisers, they did not sponsor this article.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.