Wall Street trembled, and a level of shock not seen since the outbreak of COVID shook global financial markets on Thursday due to concerns about the damage that the new set of tariffs imposed by U.S. President Donald Trump could cause to the economies of several continents, including the United States.

PUBLICIDAD

The S&P 500 lost 274.45 points, or 4.8%, to close at 5,396.52, a larger drop than in the main markets of Asia and Europe and its worst day since the economy collapsed in 2020.

PUBLICIDAD

The Dow Jones industrial average fell 1,679.39 points, or 4%, to settle at 40,545.93, and the Nasdaq composite plummeted 1,050.44 points, or 6%, to close at 16,550.61.

Little was saved in the financial markets while fear was ignited by the potentially toxic mix of weakening economic growth and higher inflation that tariffs can create.

Everything fell, from crude oil to the stocks of big tech companies, to the value of the US dollar against other currencies. Even gold, which recently hit records as investors sought something safer to hold, lost ground. Some of the hardest hits were suffered by smaller US companies, and the Russell 2000 index for small businesses fell by 6.6% to more than 20% below its record.

What was the impact of Trump’s announcements?

Investors around the world knew that Trump was going to announce a broad set of tariffs on Wednesday afternoon, and fears about it had already caused Wall Street’s main health measure, the S&P 500 index, to fall 10% below its all-time high. But still, Trump managed to surprise them with “the worst-case scenario for tariffs,” according to Mary Ann Bartels, chief investment officer at Sanctuary Wealth.

Trump announced a minimum tariff of 10% on all imports, and a much higher tax rate on products from certain countries such as China and those from the European Union. It is “feasible” that the tariffs together, which would rival levels not seen in about a century, could reduce the economic growth of the United States by two percentage points this year and increase inflation to around 5%, according to UBS.

A blow like that would be so big that “it makes the rational mind consider the possibility of them being maintained as low,” according to Bhanu Baweja and other UBS strategists.

Wall Street had long assumed that Trump would use tariffs simply as a tool for negotiations with other countries, and not as a long-term policy. But Wednesday’s announcement could indicate that Trump sees tariffs more as a help to achieve an ideological goal than as an initial move in a poker game. The US President spoke on Wednesday about bringing back manufacturing jobs, a process that could take years.

Best Buy fell by 17.8% because the electronics it sells are manufactured worldwide. United Airlines lost 15.6% because customers concerned about the global economy may not fly as much for business or feel comfortable taking vacations. Target plummeted by 10.9% amid concerns that its customers, already under pressure from still high inflation, may be under even more stress.

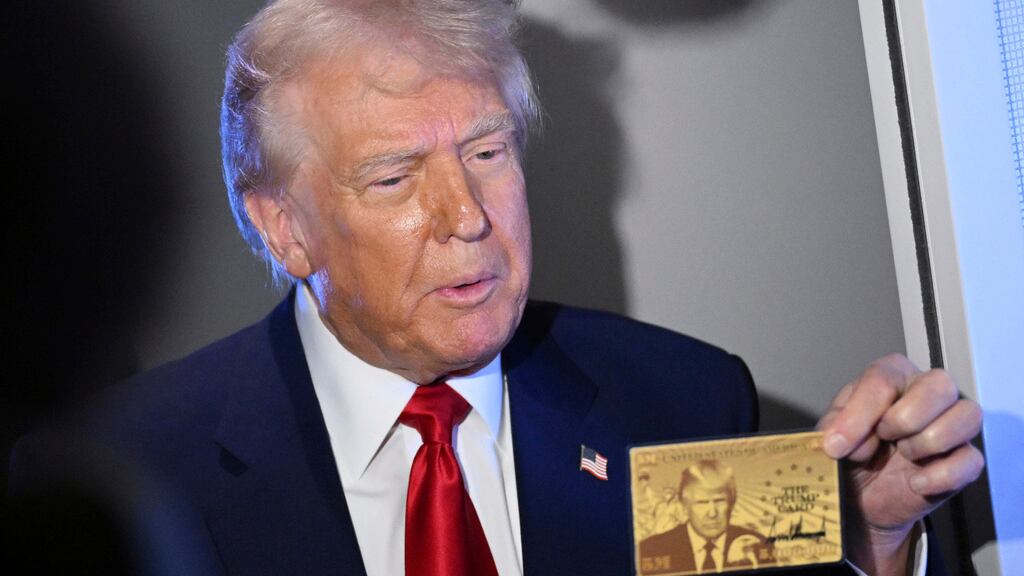

Trump’s response? “It’s going very well”

Trump offered an optimistic reaction after being asked about the market’s fall as he left the White House to travel to his golf club in Florida on Thursday.

“I think it’s going very well,” he pointed out. “We have an operation, like when a patient is operated on and it’s something big. I said this would be exactly like that.”

He spoke, without providing any other details, about billions of dollars in investments that are “coming to our country” from companies that want to manufacture their products in the United States to avoid tariffs.

One ace up the sleeve is that the Federal Reserve could cut interest rates to support the economy. That’s what it had been doing at the end of last year before pausing in 2025. Lower interest rates help facilitate borrowing and spending for American businesses and households.